Did you know that you can see your credit report for free in Canada?

Before applying for a loan, whether it’s for a new car or a mortgage, you should always check your credit report first. Lenders generally check your credit report to help determine your creditworthiness, how much to lend to you, and what rate to charge you. That’s why it’s important to review your credit report regularly to ensure it’s accurate, as well as to see what your credit strength is like before applying for credit.

Find out how to get a free credit report in Canada.

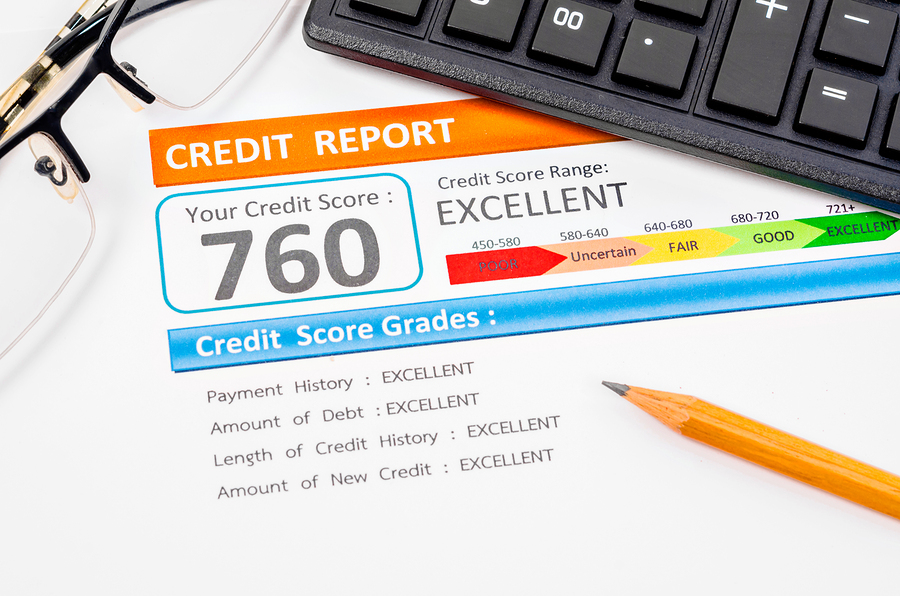

A credit report includes information about your credit accounts and how you’ve used them. This includes your payment history, credit inquiries, and types of credit used, all of which may be seen by lenders when they pull your credit report. Other information includes public records like bankruptcies and debts sold to collections.

You can obtain your credit report from the credit bureaus in Canada or from third-party credit reporting agencies.

Both credit bureaus in Canada, Equifax and TransUnion, provide credit reports for free.

Transunion refers to your credit report as a Consumer Disclosure. A Consumer Disclosure is a report that contains all of your credit report information as mandated by the consumer reporting legislation. It includes your personal, account management, credit, and non-credit inquiries.

You can request access to your Consumer Disclosure in the following ways:

You can access your Equifax credit report and credit score in the following ways:

Yes, you can not only get your credit report for free with Canada’s credit bureaus, but you can also get your credit score. You can also use third-party services to get free access to your credit scores:

| Cost | Credit Score | Credit Report | ||

| Free | Yes | Yes | Visit Site | |

| Free | Yes | Yes | Visit Site | |

| Free | Yes | Yes | - |

When you check your own report, this is a soft inquiry that will not impact your credit score. This should be done regularly as a way to find out where you stand when you apply for credit, or if you’re taking steps to improve your credit and monitor your progress. Checking your credit report is also a good way to help ward off identity theft by spotting suspicious activity early before the issue gets worse.

Here is a list of the personal and credit-related information that will show up on your free credit report in Canada:

Some details about your personal information will be on your credit reports:

The following information regarding your credit accounts will be noted on your credit reports:

A record of all your credit-related actions will remain on your report for several years, though the exact length of time depends on the type of remark in question. For example, late payments will stay on your report for 6 years, while hard inquiries will remain for 3 to 6 years, depending on the credit bureau.

Each account will be listed in your credit report, identified by a number and a letter:

| I | Installment Loan (loans that are paid off in monthly installments) |

| O | Open Status (you can borrow up to a predetermined limit) |

| R | Revolving (you can borrow up to a predetermined monthly limit, payments fluctuate based on how much you’ve borrowed) |

| M | Mortgage (installment loans for homes that, in some cases, do not appear on your credit report, depending on which credit agency you’re checking with) |

| 0 | the account is not yet used or too new to merit a rate |

| 1 | the account has been paid off within the agreed time limit |

| 2 | payments made 31 – 59 days late |

| 3 | payments made 60 – 89 days late |

| 4 | payments made 90 – 119 days late |

| 5 | payments made over 120 days late |

| 6 | the account is not used |

| 7 | the account is in consolidation, consumer proposal or a debt management program |

| 8 | the account is in repossession |

| 9 | the account is in heavy debt, and has been sold to collections or filed for bankruptcy |

Example of a Candian Equifax credit report (click here for more information).

When you start using credit products, your credit report will be created by the two major credit reporting agencies in Canada: TransUnion and Equifax. As your lenders and creditors report your credit information to the credit bureaus, your credit scores will be calculated and updated as new information comes in.

However, do note that not all lenders and creditors report to both credit bureaus. Some will report to only one, while others may not report to either. That’s why you may notice slight differences in your credit scores between both bureaus.

If you’re looking to build your credit history, be sure to ask your lender or creditor if they report to both credit bureaus.

Your credit report and your credit scores are two separate things. However, your credit scores are heavily related to your credit report.

As mentioned, your credit report summarizes your credit history and is created when you apply for credit. Lenders send information about your credit accounts to the credit bureaus.

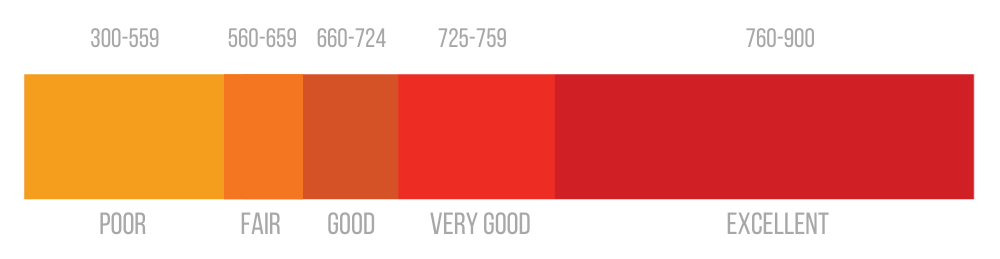

Your credit scores are calculated using the information in your credit report. They’re three-digit numbers between 300 and 900 that tell lenders and creditors how likely you are to pay your bills and debts on time.

Your credit scores may also be used by landlords to confirm that you’re an individual who will pay their rent on time, or employers when you apply for certain jobs that rely on their employees’ financial responsibility.

Your credit score is calculated using the information in your credit reports, as mentioned. However, there are different credit scoring models, so depending on the credit bureau, your credit score may vary.

That said, there are five main factors used to calculate your credit scores:

Your credit score is rated according to where it falls within specific ranges, as follows:

Lenders typically want to see credit scores that are at least within the ‘good’ score range. Good credit means you’re more likely to pay your bills on time and are less of a risk. The higher your score, the higher your chances of getting approved for credit products at more affordable rates.

Several companies and individuals may access your credit report in Canada.

When you apply for credit, the lender or creditor can access your credit report to assess your creditworthiness and decide whether to approve your application and what rate and terms to offer.

Applying for credit typically involves a hard credit check, which can pull your credit score down.

Insurance companies may look at your credit report and credit score to evaluate your risk level and determine the premium rate to charge you. These are typically soft credit checks, which don’t hurt your credit score.

Landlords may ask to see your credit report when you apply for a lease. They use this information to assess your financial responsibility to ensure you’ll pay rent on time every month. Credit checks from landlords are considered hard inquiries, which may negatively affect your credit score.

Certain types of jobs, especially those within the financial sector or that require dealing with sensitive information, may require a credit check from your prospective employer as part of the hiring process. When employers pull your credit report, they’re typically considered soft inquiries, which will not harm your score.

Some government agencies may look at your credit report for purposes such as verifying your identity, determining your qualifications for certain benefits, or investigating fraud.

If you default on your credit accounts, your creditors may sell your debt to a collection agency. These agencies may access your credit report to get information about you as a way to collect the debt. Credit checks done by collection agencies are usually hard pulls, which can negatively affect your credit score.

If you notice errors on your credit report, you should speak with the appropriate party to have them fixed or removed. Inaccuracies on your credit report can not only pull your credit score down, but they can also be a sign of potential fraud. In these cases, you may want to take measures to have these mistakes removed from their credit report.

This is why it’s so important to pull your credit report on a regular basis to give you the opportunity to scan your report for inaccuracies.

Speak With Your Lender — If the mistake is credit account-related, you may be able to rectify the situation by contacting your lender first and asking them to verify their records and provide the credit bureaus with accurate information.

Reach Out To The Credit Bureau — When you contact the credit bureau, you may need to provide various pieces of information to identify yourself. You may also need to provide various supporting documents to back your claim, such as statements and receipts related to your credit accounts.

Both your credit report and your credit scores are valuable financial tools that can help you access different financial products and services. Lenders and creditors generally use your credit report to determine your creditworthiness and whether you’re likely to repay the loan. So, it’s important to regularly check your credit report and ensure that there are no errors in the information reported, as it can impact your ability to access future credit. Fortunately, you can access your credit reports for free from the credit bureaus and various online resources.